Bharat Dynamics Ltd – Missile giant

- Monith Biswojyothi

- Jun 27, 2022

- 4 min read

Updated: Jun 29, 2022

Company Name – Bharat Dynamics Ltd (BDL)

Current Share Price – INR 728 (June 24, 2022) Market Cap – INR 13,344 cr |

1. What is interesting about the stock?

India’s defeat by China in the 1962 border war, probably more than any other war, galvanized its leadership to build indigenous missile and “threshold” nuclear weapons capabilities as a credible deterrent against attacks by China, and to attain military superiority over Pakistan. Thus in 1978 started a frantic search to identify a site for the establishment of instrumented missile testing range facility, the only suitable site was found at the Balasore coast of Odisha. A decisive shift in missile development plans occurred in 1983 when the Indian government launched the ambitious Integrated Guided Missile Development Program (IGMDP). The program involved the development of a family of strategic and tactical guided missiles. The mandate was to develop 5 different missiles – Agni, Prithivi, Akash, Nag & Trishul. Agni is the first story that made India an innovative country as far as missile technology is concerned; the Defence Research & Development Organization (DRDO) developed it under Dr. APJ Abdul Kalam’s leadership. The success surprised many developed nations and invited their wrath too. India described the Agni at that stage as a “technology demonstrator”.

However, India needed anti-tank missiles even before the development of its indigenous multi-use missile programs. This gave birth to one such Indian defense giant – Bharat Dynamics Limited (BDL) in 1970. It started its journey with just single product selling to a single customer in a hired building and has now grown as a multi-product, multi-customer & multi-location enterprise. Starting from an Anti-Tank Guided Missile (ATGM) manufacturing, company has forayed into the fields of Surface-to-Air Missile Weapon Systems, Air-to-Air Missile weapon Systems, underwater weapon systems, and associated equipment and also refurbishment of missiles. It is the sole manufacturer of Missiles, Torpedoes, Counter-Measures Devices, and Weapon System integrator for the Armed Forces. It has currently a very strong product portfolio with 3 manufacturing facilities in Hyderabad, Vishakapatnam & Bhanur. It is associated with DRDO as Development Partner as well as a Production agency for various programs. It has Transfer of Technology (ToT) Agreements with major foreign OEMs; they are exploring new avenues with leading Foreign OEMs for the production of new Missile weapon systems in India. It has designed and developed unguided bombs for dropping from drones as per the requirement of the Military College of Electronics and Mechanical Engineering (MCEME), Secunderabad.

BDL currently has an order book of INR 13,000 cr (~4.5x of FY22 revenue) with another INR 8,000 cr orders in pipeline. Exports are expected to be a key avenue of growth for BDL in the future; it has orders of INR 349 cr to export Light Weight Torpedoes & Counter Measures Dispensing System (CMDS) to friendly foreign countries. A defense export strategy has been formulated with a view to facilitating Defense Public Sector Undertaking (DPSUs) and private players in exploring business opportunities overseas. BDL has recently entered into MOUs with DRDO, BHEL, Tawazun Holding Company LLC, UAE to kick start new projects and businesses.

Key Strengths.

Strong moat – the monopolistic nature of this business, it is a mini-ratna company poised to become a maharatna in a few years. Strong order book & products under pipeline demonstrates this along with the support of government & armed forces.

Make in India push - Indian armed forces require severe up-gradation of its infrastructure & weapons systems. BDL is the only company that is allowed to forge partnerships/MOUs with various equipment manufacturers across the globe, indigenize the products & manufacture at scale. This privilege is unseen in any sector in India.

BDL has commenced massive indigenization of components & sub-assemblies of various programs that were being imported by the company. This is expected to save INR 930 cr for the country.

Key Weaknesses

BDL does not have high-tech electronics capabilities. Hence, it will face difficulties in competing with private players in emerging markets. It also has a long road ahead in terms of imbibing manufacturing automation, robotics operated workshops, Industry 4.0 solutions, and IT products.

2. Key Historical Financials

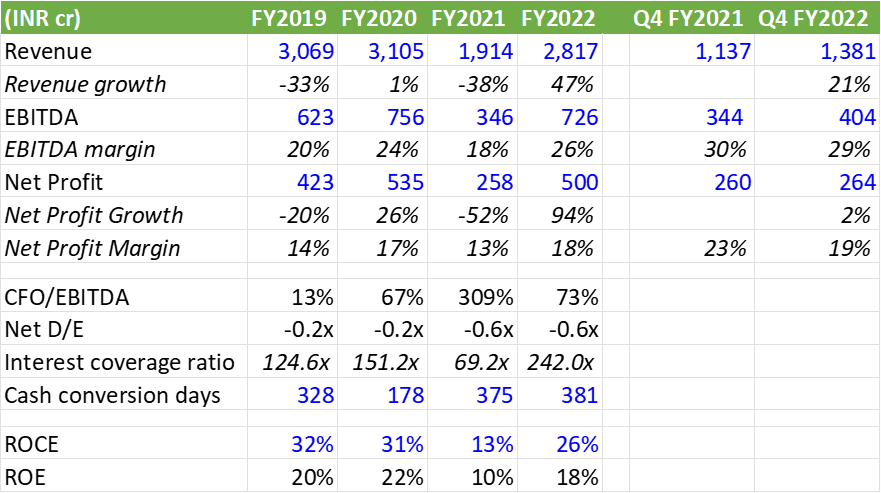

Company revenue hasn’t grown since FY19 – fallen significantly in FY21 but recovered in FY22

EBITDA margin has expanded in FY22 to 26% vs 18% in FY21

Cash flow convertibility (CFO/EBITDA) was very good in FY21 when the trade receivables fell significantly, and the payables got stretched. It has normalized in FY22

With the business turning around in FY22, the return ratios (ROCE/ROE) are recovered in FY22 to 26% and 18%

3. What is my view on company valuation?

Bharat Dynamics Ltd has given almost 100% returns in the past one-year period. Company trades at a TTM P/E of 25x (vs 5 year average P/E ratio of 14x) and ROCE of 26%

BDL has hugely improved metrics in FY22 compared to FY21. The question to ponder is whether BDL can maintain these growth rates and keep performing without any hiccups in the long term. The historical track record is not impressive.

BDL is overvalued and hence investors looking to invest for the long-term can evaluate it after significant correction.

4. What are the risks to the investment analysis?

Key risks to investment analysis are:

Highly dependent on one single customer, the Indian Armed Forces. A decline or reprioritization of Indian defense budget, reduction of their orders, termination of contracts or failure to succeed in tendering projects can have an adverse impact on company’s business.

The company is subject to a number of procurement rules and regulations laid down by Ministry of Defence. The company’s business could be adversely impacted due to sudden and unforeseen change in applicable rules.

About the Author

I have over 7 years of work experience in the Automobile Industry & Technology Sector in India. Currently, I am working as a Research & Development Engineer at a Global Automobile major helping them scale their Electric Vehicles ambitions.

I hold Master’s & Bachelor’s degrees in Engineering from the Indian Institute of Technology, Madras (IITM).

I am an insignificant public investor & have an avid interest in Trekking, Photography, and Cybersecurity.

Disclosure

I have no stock, option, or similar derivative position in any of the companies mentioned in the last 30 days, and shall not initiate any such positions within the next 5 days. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SocInvest). I have no business relationship with any company whose stock is mentioned in this article.

I am not a SEBI registered advisor. This article is purely for educational purposes and not to be construed as investment advice. Please consult your financial advisor before acting on it.

I have used publicly available information while writing this article.

Comments