Escorts Ltd – Powering Agriculture

- Karan Patel

- May 9, 2022

- 7 min read

Updated: Jun 9, 2022

Company Name – Escorts Limited (Escorts) Current Share Price – INR 1,568 (May 6, 2022) Market Cap – INR 20,690 cr |

1. What is interesting about the stock?

The agricultural sector in India is a story of 2 extremes. On one hand, the sector is the largest employer in India with an over 45% share in India. It also accounted for ~19% of India’s GVA in FY21 & FY22. India is the 2nd largest producer of wheat and rice in the world, along with a top 3 position in various food crops including pulses, tubers, tea, etc., and cash crops including cotton, sugarcane and others.

But on the other hand, the sector has been mired in a host of problems including low productivity, poor infrastructure support, a small share of organized retail and many others. Among these, the biggest drag on the sector is the production yields which are much lower than other agri-focused nations like Brazil, USA, France and others. Total productivity growth in India remains below 2% per annum vs 6% per annum for China, even when China and India are both nations dominated by small farm holdings.

The chief reason cited for this poor productivity is the small size of land holdings, which limits the mechanization of farms.

Although the Indian agricultural sector is unsuitable for large machineries like combine harvesters and cultivators, there is a lot of room for growth in productivity with the increased adoption of India specific tractors and their use.

Here is where Escorts comes in.

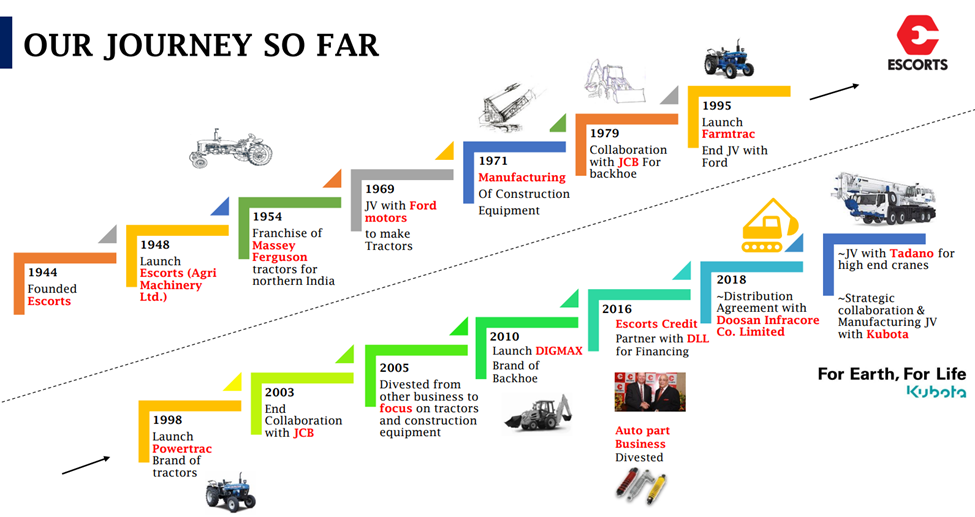

Escorts is one of the largest farm machinery companies in India. It has been operating in this sector since 1961. It has collaborated with various automakers over the years including Massey Ferguson, Ford Motors, JCB, and Kubota to develop one of the most widely used range of tractors in India today.

The Company has also diversified into parallel segments like construction equipment (11% of revenue in FY21) and railway equipment (7%). But the agri-machinery segment remains its mainstay accounting for 82% of revenue in FY21.

The company is present across all power segments from 11 BHP to 120 BHP in the agri sector with famous brands like PowerTrac, FarmTrac, SteelTrac, PowerMaxx and others.

It also has an active dealer network of over 1,100 dealers across India with a strong presence in North and Central India.

It has 3 manufacturing plants for agri-machinery with a combined capacity of over 1.2 lakh units per year. It also has a Polish subsidiary with a capacity of 2,500 units per year and a JV with Kubota with 50,000 units per year capacity.

In construction equipment, the company has a capacity of 10,000 units per year.

The Company faces strong competition from TAFE and Mahindra & Mahindra, who have been rivals for Escorts since the 1960s when all three started selling tractors in India. Escorts has not been as proactive in marketing as TAFE and Mahindra who have grown their brands on the back of strong marketing over the years.

The Japanese manufacturing giant, Kubota, a global tractor maker and the largest tractor brand in Asia with a presence across all segments in the agriculture sector from farm to store, has taken over control of the Company and become its promoter. It also has a big presence in construction equipment and engine manufacturing. All of this is expected to help Escorts in terms of technology and industry practices along with exposure to a bigger export market and developing construction equipment business.

Kubota acquired 6.49% of the company earlier at a price of INR 2,000 per share which was at a 29.5% premium to the share price of INR 1,544 in its preferential allotment. It also made an open offer to the public shareholders of Escorts at the same price in March which was fully accepted and it now brings the Kubota stake in Escorts to 44.8%.

Industry Overview

The domestic tractor industry has grown at a CAGR of ~10% in the past decade. India has emerged as the largest manufacturer of tractors in the world with 1/3rd of the world's production capacity. The industry saw sales of almost 0.9 million units in FY21 and expects to see sales rise to 1.2-1.5 million units by 2030.

There are other long-term factors that are expected to help in the growth of the tractor sector in India:

Rising mechanization

Rise in MSPs for crops benefiting the entire agri-sector

Decrease in labour availability for the agri-sector, which increases demand for machinery

Easy credit availability from the Government

The industry is dominated by the 41-50 BHP segment which accounts for 52% of the domestic market by volume, while the 31-40 BHP segment accounts for 37% of the overall tractor market.

Tractor exports from India are also expected to rise at a CAGR of 6-8% given the low-cost manufacturing advantage of India and the presence of large tractors makers like M&M and TAFE.

The construction equipment industry is also expected to see good demand in India due to the ongoing construction and infrastructure development boom. The focus on Make in India is also expected to benefit local manufacturers of heavy equipment.

The railway machinery sector is also expected to rise in demand, mainly due to the demand for more sophisticated machinery after the modernization of trains and the railway sector in India. But this demand is expected to be slow and steady as the transformation of railways in India is a slow process given the large requirement of capital and effort required.

The major listed competitors of Escorts in India are:

Mahindra & Mahindra

VST Tillers Tractors

The Company also has other unlisted rivals like TAFE & Sonalika (International Tractors Limited) in the Indian market.

Key strengths (Why to invest in Escorts?)

Brand strength and long industry presence - The Company is one of the most recognizable tractor brands in India, and is also the oldest operating tractor company in the country

Association with Kubota - Kubota is the promoter of Escorts with a 53.3% shareholding in the company. It is a global tractor and equipment maker that can provide Escorts with support in terms of exports’ markets, technology as well as capital for expansion

The Company is almost debt-free with a AA rating and good operational metrics, including RoCE of 26% in FY21. It has seen a good rise in operating efficiency over the years, with EBITDA margin rising from 5% in FY16 to 16% in FY21

2. Key Historical Financials

The Company saw its sales growth CAGR for the last decade of over 8%. It has also seen a PAT CAGR of 21%. Sales CAGR in the past 5 years was at 15%, while PAT CAGR in the same period was 65% due to a rise in operational efficiency for the Company.

FY21 was a great year for the company which saw a 24% YoY rise in volumes along with a 29% rise in exports along with over 90% capacity utilization. This aided the EBITDA margin to rise within the year which rose to above 20% in Q3FY21 before coming down over successive quarters due to a continuous rise in raw material prices, especially steel. Q3FY22 on the other hand saw revenue and EBITDA margin drop due to the continued raw material price inflation and a sharp YoY drop of 23% in domestic volumes during the winter vs the large base in Q3FY21.

3. What is my view on Company valuation?

Escorts has seen a rise in its share price of ~175% in the last 5 years vs the Nifty 50 Index which has risen ~90% in the same period. The Nifty Auto Index has risen only 10% in the same period.

This shows that the company has outperformed the general market and has significantly outperformed the auto sector in India.

The company trades at a P/E of 25x vs 20x for M&M & 25x for VST Tillers. It also trades at an EV/EBITDA of 17x vs 11x for M&M & 15x for VST Tillers.

The wide difference in valuation between Escorts and M&M is expected to be mainly arising from the poor performance of the passenger vehicle segment for M&M in the last 5 years.

Based on the great potential for farm mechanization in India, the other opportunities in non-core businesses like construction and railway equipment, and likely synergies from the closer association with Kubota, I expect Escorts to have a steady growth momentum going forward and have revenue growth above 15% on an annualized basis for the next few years.

At its current valuation, the stock appears to be expensive by global standards, given that Kubota itself trades at a P/E of 13x currently and the global farm equipment industry P/E is at 21x. But given its potential and the change of promoter to Kubota, it is a good stock for long term investors to evaluate.

4. What are the risks to the investment analysis?

The major risks here are:

Dependence on the agricultural sector. Farm equipment accounted for over 82% of revenues in FY21 and this exposes the Company to all the risks associated with the farming sector in India

Highly competitive industry - The Company faces pressure from competitors like Mahindra & Mahindra, TAFE, Sonalika, John Deere, Force, VST Tillers and many others. This reduces the pricing power of the company

Raw materials account for over 66% of costs for the Company making it highly vulnerable to commodity price inflation

A note of caution: Famed investor, Rakesh Jhunjhunwala, was holding 75 lakh shares representing 5.68% of the total shareholding during the quarter ended December 2021. He was bullish on the business and was holding the stock since December 2015. However, in March 2022 shareholding, Rakesh Jhunujhunwala’s name is not there on the list of shareholders - he has tendered a 3.57% stake in the open offer (which is expected to have a ~70% acceptance ratio) and sold some stake to go below 1%.

About the Author

I have over 6 years of experience in the Investment sector and have been an active prop trader in European Bond Futures in the past. Currently I am working as head of Research at Smart Sync Services where we are working on simplifying and expanding financial and investment knowledge to make the investment world as accessible for everyday investors as much as possible.

I graduated from the Master of Finance Program from Cambridge University in 2016 after completing my Bachelor of Engineering program from Jadavpur University, Kolkata in 2011.

I am an insignificant public investor & have avid interest in following emerging trends both in technology and other fast evolving sectors. I am also a lifelong learner and relish the chance to learn something new all the time.

Disclosure

I have no stock, option or similar derivative position in any of the companies mentioned since last 30 days, and shall not initiate any such positions within the next 5 days. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SocInvest). I have no business relationship with any company whose stock is mentioned in this article.

I am not a SEBI registered advisor. This article is purely for educational purpose and not to be construed as an investment advice. Please consult your financial advisor before acting on it.

I have used publicly available information while writing this article.

Comments