Rainbow Children's Medicare – Multi-Specialty Pediatric Hospital Chain

- Team SocInvest

- Apr 10, 2023

- 5 min read

Updated: Sep 21, 2023

Company Name – Rainbow Children's Medicare Limited (Rainbow) Current Share Price – INR 740 (April 3, 2023) Market Cap – INR 7,511 cr |

1. What is interesting about the stock?

The hospital chain has a high Average Revenue Per Occupied bed (APROB) or daily room charges and high EBITDA per bed vs competition – we should ponder whether that’s good.

Hospitals play a critical role in society, and their primary goal should be to provide quality healthcare services to patients. While generating profits is important to sustain hospital operations and ensure that they can continue to provide quality care, excessive should not be the focus.

In my opinion, hospitals should strike a balance between generating profits and making healthcare more accessible. Healthcare is a basic human right, and it's important to ensure that everyone has access to quality care, regardless of their ability to pay. Hospitals should explore innovative ways to make healthcare more accessible, such as partnering with government organizations and non-profits to provide affordable care to low-income patients.

One such hospital with high APROB and EBITDA per bed is Rainbow.

Rainbow Children's Medicare Limited operates a multi-specialty pediatric, obstetrics, and gynecology hospital chain in India. The Company offers a wide range of services such as newborn and pediatric intensive care, pediatric multi-specialty services, pediatric quaternary care, obstetrics, and gynecology.

Rainbow Children's Medicare was established in 1999 and has since grown to become one of the largest healthcare providers for children in India. The hospital chain has 16 hospitals across various cities in India, including Hyderabad, Bangalore, Chennai, Delhi, Visakhapatnam, and Vijayawada. The total bed capacity of Rainbow is more than 1,550.

The hospital chain provides a wide range of healthcare services for children, including neonatology, pediatric intensive care, pediatric surgery, pediatric cardiology, pediatric neurology, and other subspecialties. The hospital chain also offers obstetrics and gynecology, including normal and complex obstetric care, multi-disciplinary fetal care, and perinatal genetic care, as well as fertility treatment, where they offer a wide range of assisted reproduction treatments.

The hospitals are equipped with advanced medical technologies and equipment, and the medical staff comprises highly trained and experienced pediatricians, surgeons, and nurses.

‘Birthright by Rainbow’, the perinatal offering of Rainbow, focusses more on high-risk pregnancies. It has established professional connections with city and district obstetricians to refer high-risk pregnancies to the hub hospitals, thereby strengthening high-risk pregnancy services at the hub hospitals.

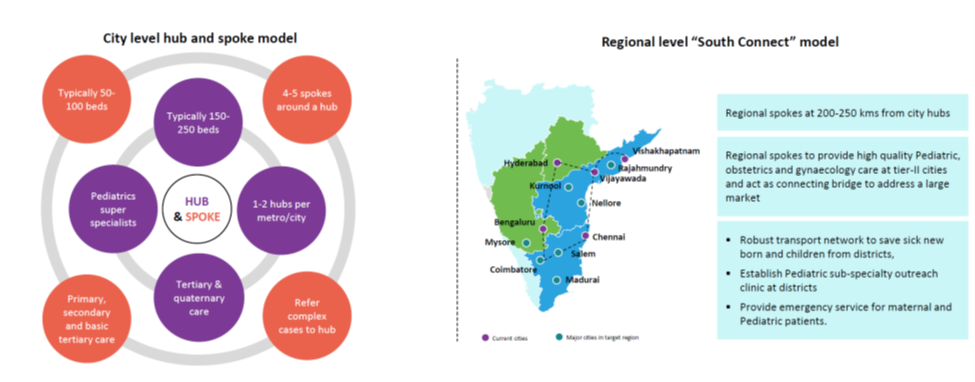

Rainbow uses a hub and spoke model, in which the flagship “hub” hospital in a particular city (like Banjara Hills in Hyderabad) provides comprehensive outpatient and inpatient care with a focus on tertiary and quaternary care, and the spokes provide secondary care in pediatric, obstetrics and gynecology, and emergency services. This model provides patients access to high-quality super-specialty care in the hub hospital, while at the same time providing access to general pediatrics and obstetrics services closer to home at the spokes.

Rainbow’s emphasis on 24X7 doctor engagement is an important tenet of its business model. Pediatric care is largely based on emergency procedures and night-time cases are frequent, thus dictating the need for an all-round doctor presence. Rainbow follows a unique doctor engagement model whereby most of its doctors work exclusively at the hospitals on a full-time retainer basis, and others are hired as part-time medical consultants. This model ensures that most of the doctors are available 24X7 on a roster basis across hospitals, which is particularly important for children’s emergency and neonatal and pediatric intensive care services.

The hospital chain has a high revenue concentration in the Hyderabad cluster that accounted for 55.5% and 70.7% of Rainbow’s overall FY22 revenue and EBITDA respectively. Rainbow entered the Delhi market in 2017 but the progress has been slow and below management expectations.

Why invest in Rainbow?

Niche segment of pediatric, obstetrics, and gynecology – under-penetrated in India and lack of large specialist pan-India player

Robust business model – hub & spoke and doctor engagement

Established operational track record of over two decades

2. Key Historical Financials

Rainbow revenue and net profit increased by CAGR of 22% and 46% respectively in the last 3 years

Revenue increased by 50% in FY22 after a fall in FY21

EBITDA margins improved to 32% in FY22 - one of the highest in the industry

Cash Flow conversion (CFO/EBITDA) fell in FY22

ROCE and ROE were 23% and 27% respectively in FY22 – also one of the highest in the industry

3. What is my view on company valuation?

Company launched its IPO in April 2022 and was hugely successful with 12x oversubscription. The issue price was INR 542. A predominant portion of the IPO was the sale of shares by the promoters (INR 1,300 cr) vs the primary infusion of INR 280 cr. The proportion of the secondary looks strange as:

Indicates that the promoters thought of limited upside potential based on the issue price

Highly underpenetrated segment should provide strong opportunities for future growth or capex

Current price of Rainbow is 1.4x the IPO issue price. Rainbow trades at an EV/EBITDA multiple of 21x vs Apollo Hospitals at 31x, Max at 34x, Fortis at 18x, and Narayana at 18x. In terms of P/E (TTM) multiple, Rainbow trades at 44x vs Apollo Hospitals at 80x, Max at 43x, Fortis at 42x, and Narayana at 31x.

On an overall basis, Rainbow is currently expensive and long-term investors could evaluate the stock at lower levels.

4. What are the risks to the investment analysis?

Risks to the analysis are:

High concentration of revenue and EBITDA from the Hyderabad cluster; limited success in the Delhi region

Current pricing seems to be on the higher side – competition could lead to lower EBITDA margins and return ratios (ROCE/ROEs)

A majority of Rainbow’s doctors are on full-time, exclusive retainership with the hospitals and are not its employees – risk of premature agreement termination

About the Author

I have over 17 years of experience in venture capital, private equity, and investment banking across various sectors in India and the Middle East. I was last working with Majid Al Futtaim Holding (MAF), a leading conglomerate in the Middle East, to look after investments, M&A, and venture capital. I have prior experience in India with Tata Capital (Private Equity), Merrill Lynch (Investment Banking or IB), and Ambit Corporate Finance (IB). I bring the long-term ownership mindset to the analysis.

I graduated from the MBA program of the Indian Institute of Management Lucknow (2005) after completing the Bachelor of Technology program at the Indian Institute of Technology, Kharagpur (2002).

I am an Insignificant Investor in the public market and co-founder of SocInvest.

Disclosure

I have no stock, option, or similar derivative position in any of the companies mentioned in the last 30 days, and shall not initiate any such positions within the next 5 days. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SocInvest). I have no business relationship with any company whose stock is mentioned in this article.

I am not a SEBI registered advisor. This article is purely for educational purposes and is not to be construed as investment advice. Please consult your financial advisor before acting on it.

I have used publicly available information while writing this article.

Comments