Vishnu Chemicals: India’s Leading Player in chromium and barium chemistry

- Soumik Sarangi

- Jan 5, 2024

- 7 min read

Company Name – Vishnu Chemicals Limited (Vishnu Chemicals) Current Share Price – INR 343 (Jan 4, 2024) Market Cap – INR 2,250 cr |

1. What is interesting about the stock?

India's chemical industry is expected to reach a market size of USD 850 billion- USD 1 trillion by 2040, capturing a 10-12% share of the global market. The sector is projected to grow steadily at 11-12% during 2021-2027, and 7-10% during 2027-2040, tripling its global market share by 2040. This growth is driven by rising domestic consumption, consumer preferences for bio-friendly products, and shifting supply chains.

In this thriving landscape, companies like Vishnu Chemicals is strategically positioned to harness the sector's growth. Specializing in chromium and barium chemicals, Vishnu Chemicals aligns with India's ambition to play a pivotal role in the global chemicals market. Chromium and barium chemicals are used in many everyday items, from pharmaceuticals to cars, and in jet engines and aircraft to protect against wear and tear. Established in 1990, by Ch. Krishna Murthy, a first-generation entrepreneur, Vishnu Chemicals has grown from a basic Chromium producer to a manufacturer of a wide range of chromium derivatives and barium products. In 2015, the Company expanded into the barium segment by acquiring Solvay Barium GMBH's barium carbonate facility in India.

Vishnu Chemicals is the leading producer of chromium chemicals in India, with integrated manufacturing facilities in Andhra Pradesh, Telangana, and Chhattisgarh. Their total installed capacity is 80000 MTPA. Export-oriented sales make up 44% of their chromium segment business, serving over 150 customers in 40+ countries. The Company has achieved a significant improvement in its financial performance by increasing its capacity utilization to over 80% from FY19-FY23, compared to 60% in FY15-FY18 through various process engineering efforts. The key competitors in this segment are Sisecam (Turkey), Elementis (USA), and Lanxess (South Africa).

The Company has also established itself as the largest producer of barium chemicals in India with a production capacity of 90,000 MTPA across barium carbonate and precipitated barium sulfate located in Srikalahasti, Andhra Pradesh. Precipitated Barium Sulphate, which was commissioned in H1 FY24 with an installed capacity of 30,000 MTPA, is an import substitute product of which Vishnu Chemicals is the sole producer in India. The Company exports 56% of its products in this segment.

In Q2 FY24, Vishnu Chemicals successfully raised INR 200 cr through a Qualified Institutional Placement (QIP). This funding will be primarily directed toward expanding the capacity of chrome metal and barium sulfate. The Company is committed to sustainable practices, investing in solar initiatives, recovering carbon dioxide for use as raw material (thus reducing its carbon footprint), and ongoing research to convert residues into finished goods.

Value Chain and Sector Analysis

Chromium Chemistry

Chromium is vital across industries, offering key attributes like corrosion resistance, color stability, and uniformity. It is particularly useful in applications such as pharmaceuticals, electroplating, ceramics, wood preservation pigments, and more. Chromium's low friction and robust resistance to corrosive agents make it a top choice, especially in hard chromium plating, addressing accelerated wear and high friction challenges.

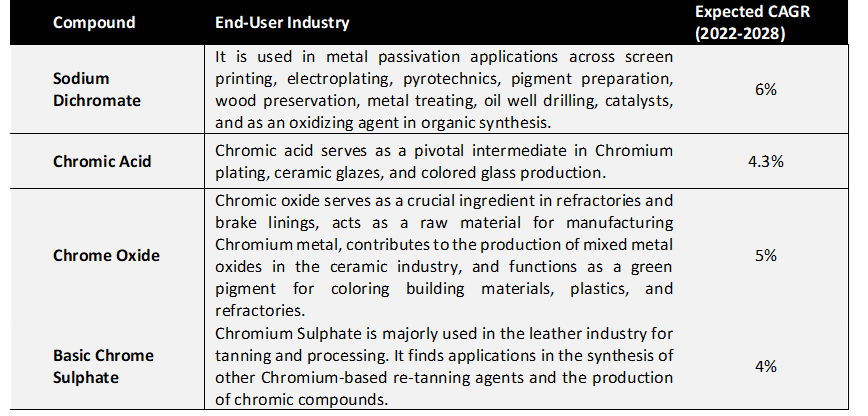

Sodium dichromate functions as the source chemical in preparing chromium-based derivatives for Vishnu Chemicals. It is a strong oxidizing agent used in metal passivation applications across pharmaceuticals, textiles, and construction. The derivative products manufactured by the company are chromic acid, chromic oxide, basic chrome sulfate, and potassium dichromate. A summary of these compounds, their applications, and demand growth rate have been summarized in the table below –

Barium Chemistry

The global demand for barium chemicals currently stands at 1.7 million tons per annum (TPA). Vishnu Chemicals focuses on barium carbonate, a key product in their portfolio. This compound is integral to manufacturing electro-ceramic materials, glazes, bricks, frits, and enamels. Widely employed as a coating for welding electrodes and in glass manufacturing, it serves as a purifying agent, ensuring uniformity in glass melt and facilitating the caustic lye brine purification process. Barium carbonate is a precursor for other Barium chemicals like chloride, peroxide, and nitrate, with an expected growth rate of 6% from 2022 to 2028.

Vishnu Chemicals has expanded its production to include precipitated barium sulphate, which is becoming increasingly popular in industries such as paint, powder coating, and battery manufacturing due to its superior tinting strength, low oil absorption, and ease of dispersion. The Company aims to increase utilization of this product to 50% by the end of FY24.

Sector Outlook and Growth Triggers

India's specialty chemicals industry is currently experiencing strong growth due to various factors such as increased demand, government policies, expanding domestic consumer base, and lifestyle premiumization. This sector accounts for more than half of India's chemical exports, making it an important player in the rapidly growing manufacturing industry. Additionally, the inorganic chemicals segment, which is the third-largest in India, has also seen significant growth, producing 355,000 metric tonnes between April and July FY23, showing a 4.4% increase. Overall, the chemical industry has been steadily growing, with the inorganic chemicals segment showing promising numbers, driven by a 12.5% CAGR in consumption and a 4.1% CAGR in imports from 2016-17 to 2020-21. With India's transition into a manufacturing hub, the chemical industry is expected to benefit from a better investment climate and reform measures, in line with the country's urban and performance-driven growth trajectory.

Key Investment Thesis

Diversification into newer products across the value chain

Vishnu Chemicals is focusing on two major products, namely chrome metal and precipitated barium sulfate. They have invested around INR 100 cr in the chrome metal project, which is expected to become operational by April 2024. The demand for chrome metal is increasing at a CAGR of 17%, and it is a significant component in superalloys and welding electrodes. Being the only manufacturer of chrome in India with all locally sourced raw materials, Vishnu Chemicals has a cost advantage in the global value chain.

The demand for barium sulphate is also increasing at a CAGR of 14%. It serves as a substitute for titanium dioxide (TiO2) in certain battery coating applications and is 60% less expensive. End users are shifting towards water-based powder-coated paints, which are more durable and cost-effective. This shift will also increase the demand for barium sulphate.

Vishnu Chemicals is exploring other value-added products such as high-purity barium carbonate for the semiconductor industry, which has significant growth potential. Additionally, the Company is researching battery chemicals to enhance its product portfolio.

Backward Integration to reduce production costs and improve margins.

Vishnu Chemicals has focussed on value engineering to reduce its production costs over the years. The Company relies on two key raw materials for its chromium compounds segment: chrome ore and soda ash. Chrome ore is mainly sourced through imports from South Africa, while soda ash held the largest share in its raw material basket, constituting over 65%. However, in a strategic move, Vishnu Chemicals has commissioned an in-house soda ash plant with a capacity of 30,000 MTPA, representing a significant shift from its previous reliance on imports. This new facility is set to cover nearly 60% of the company's soda ash requirements, contributing substantial cost savings estimated at approximately INR 8 per kg. Additionally, Vishnu Chemicals has implemented a carbon dioxide (CO2) gas recovery plant to reduce its reliance on sulphuric acid, leading to further cost savings.

In the Barium sector, Vishnu Chemicals acquired Ramadas Minerals, which has a baryte ore beneficiation plant, in July 2023. Ramadas Minerals is renowned for its beneficiation plant, which utilizes US-patented technology to eliminate impurities from baryte and produce superior-grade barium - the primary raw material for the Barium division of Vishnu Chemicals. This acquisition is anticipated to further enhance the Company's EBITDA margins.

2. Key Historical Financials

Vishnu Chemicals has a 3-year sales compound annual growth rate (CAGR) of 27% and a profit CAGR of 82%. Over the last 4 years, the Company has steadily improved its EBITDA margins from 12% to 17%. Vishnu Chemicals has high return ratios with ROCE of 30% and ROE of 32% in FY23

Company is faced with falling revenue and profitability in Q2FY24 on a YoY basis

Over the past 5 years, the company has been consistently lowering its debt-to-equity ratio and aims to further reduce its gross debt by INR 40 cr in FY24. The promoter pledge has also decreased significantly from 45% in FY19 to just 3% in Q1 FY24, demonstrating the management's commitment to enhancing the quality of its balance sheet. However, the debt levels should remain a key monitorable for interested investors.

Another key monitorable for Vishnu Chemicals is the CFO/EBITDA ratio which has been in the range of 60%. There is a scope for improvement as newer products are introduced and the raw material sources are diversified with backward integration.

3. What is my view on Company valuation?

Vishnu Chemicals currently trades at a TTM PE of 19x vs its 5-year median PE of 13x. Considering the growth prospects in the end-user industries, investors can evaluate this script for long-term investment purposes at lower levels.

According to management, the chromium business is expected to grow by 10-15% in volume, while the barium business is expected to grow by 30% in the medium term. Considering the potential for expanding profit margins, Vishnu Chemicals has the potential to achieve a 20% CAGR in PAT growth in the medium term after the near-term normalization of revenue/profits.

4. What are the risks to the investment analysis?

Risks to the analysis are:

Exports comprise 50% of the total revenue for Vishnu Chemicals and will continue to remain a key growth driver for the Company. However, any divergent trends in the export segment could potentially impact the overall performance of the Company. Operating Margins might also be affected by the volatility in the freight and logistics costs.

Vishnu Chemicals has greatly benefited from its cost-effective business model, giving it a competitive edge over global peers. However, the Company's future earnings growth trajectory could be negatively impacted if aggressive pricing strategies by global competitors lead to price erosion.

About the Author

I am an MBA grad from the Indian Institute of Management, Bangalore, and currently working as a corporate finance specialist in a technology-based startup. I have cleared all 3 levels of CFA, US. I am an avid reader of businesses and like to analyze emerging trends in various sectors and macroeconomy.

Disclosure

I have had no stock, option, or similar derivative position in any of the companies mentioned for the last 30 days, and shall not initiate any such positions within the next 5 days. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SocInvest). I have no business relationship with any company whose stock is mentioned in this article.

I am not a SEBI registered advisor. This article is purely for educational purposes and is not to be construed as investment advice. Please consult your financial advisor before acting on it.

I have used publicly available information while writing this article.

Comments